Weekly Market Outlook 4.13.25

Before I begin this weeks outlook and move forward with markets I want to touch on mental health. Although it was not trading related, I feel that in these market conditions, and always, this industry is just as affected by the internal struggles that many go through. This past week I lost a great friend to suicide. As a police officer this affliction is all too common and one that has yet to find an adequate solution. Many hide their struggles and the darkness overwhelms them until the only choice they think they have is making a permanent decision to end it all. There is so much more to life than our employment status, money problems, relationship issues and anything else that could be eating at you from the inside. If you are going through it there are countless others who have been there. As I reflect on the great man that we lost this week, I will always remember the way he lifted so many others up, how great of a teammate he was and especially the way he loved his wife and kids. So many questions are left unanswered for so many and by taking his own life, he ultimately affected so many others in the wake of it all. We will never know what will be the last straw when it comes to the emotional burdens many feel but we can start to recognize it in ourselves. Trading is a lonely venture of you vs you at the end of the day. If you are feeling the burdens of financial pressures, or social media inadequacies you are not alone. If you have nobody that will understand you, we will. Send me an email, message me on social media or just leave a note in our contact box. I do my best to be as accessible as possible within reason. Join a trading community, find an outlet and be honest with your loved ones because they may not understand the inner workings of what you are doing, but they will do their best to understand you as a person. If you are letting this industry eat your emotional capital then you may just need to take a break, not quit, but step back, recalibrate and then get back to work. I know this is a somber way to start the week but I feel that it needed to be said, for many of you and for me as well. Make sure you check on your friends, family and loved ones because you never know what tomorrow brings. I have attached a link below to allow people to donate to his family if you feel so inclined. With all that out let us get into the markets.

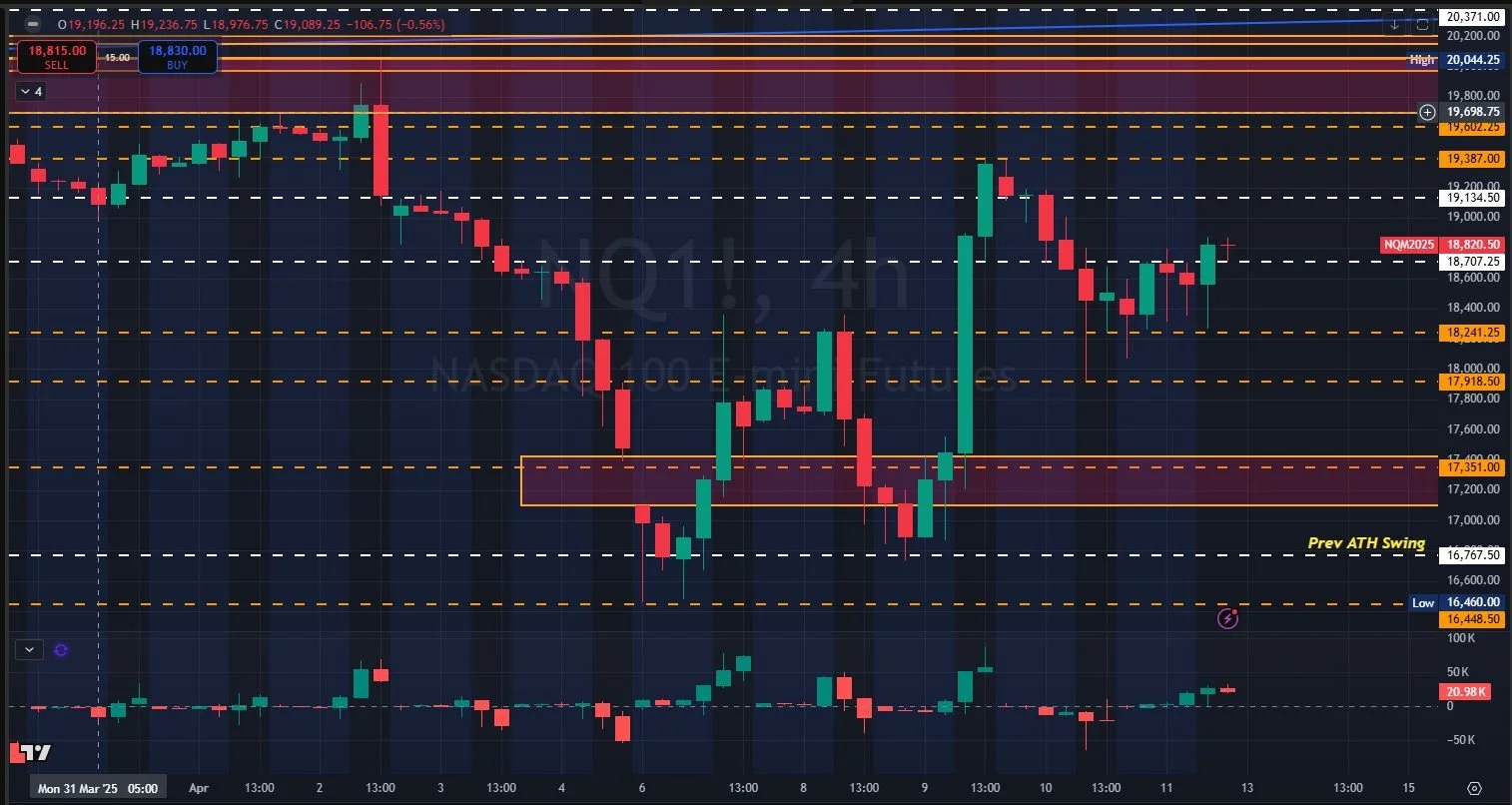

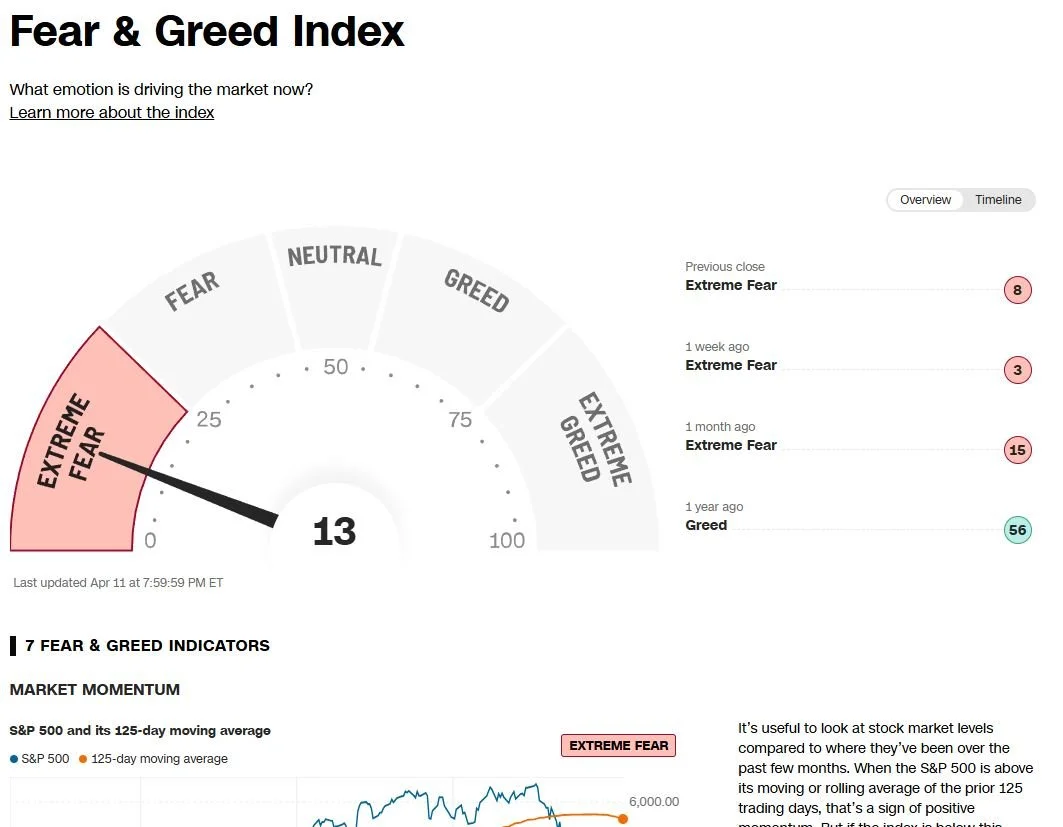

What a time in markets. I have been harping on the headline driven market narrative and I think you can believe me now in what has been just some historic price movements. The start came in when Trump announced the tariffs after hours on April 2. The flood gates opened and selling began to pour in, nearly limit down each day into the weekend and on open last Sunday. We opened with a gap down on fears of a “Black Monday” around the newswires. Like I have mentioned, when you get that fear in the public eye you may get that opposite reaction, sure enough Black Monday did not happen and we recovered the gap down. As the week progressed we were in a constant state of potential limit down behavior and never got that halt. One fake tweet led to a huge bounce, and then the real 90 day pause came in and we went on to have the second largest daily move in NQ history on Wednesday. Thursday seemed to be more of a technical pullback after such a huge move on Wednesday but still was living on headlines and political chatter. Finally after such wild volatility Friday was a day of rest. We stayed inside all day and understandably I do not believe participants wanted to go into the weekend with big positions on. This might have been a good choice as we got some headlines coming in yesterday that could gap us up big on open today.

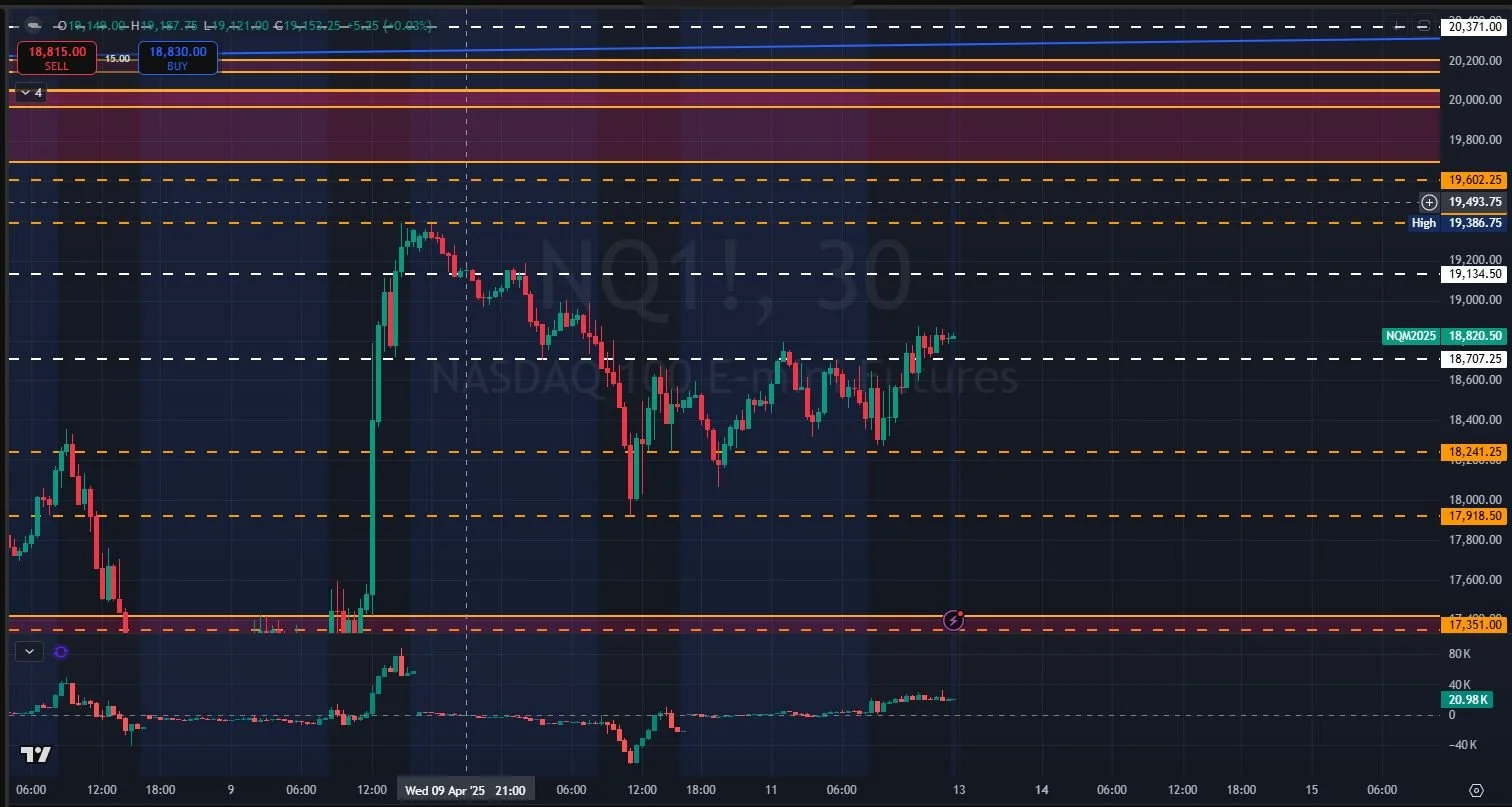

4 Hour NQ chart showing the wild swings we had since the tariff announcement.

RED FOLDER DATA FOR THE WEEK AHEAD:

EARNINGS FOR THE WEEK:

HEADLINES FOR THE WEEK:

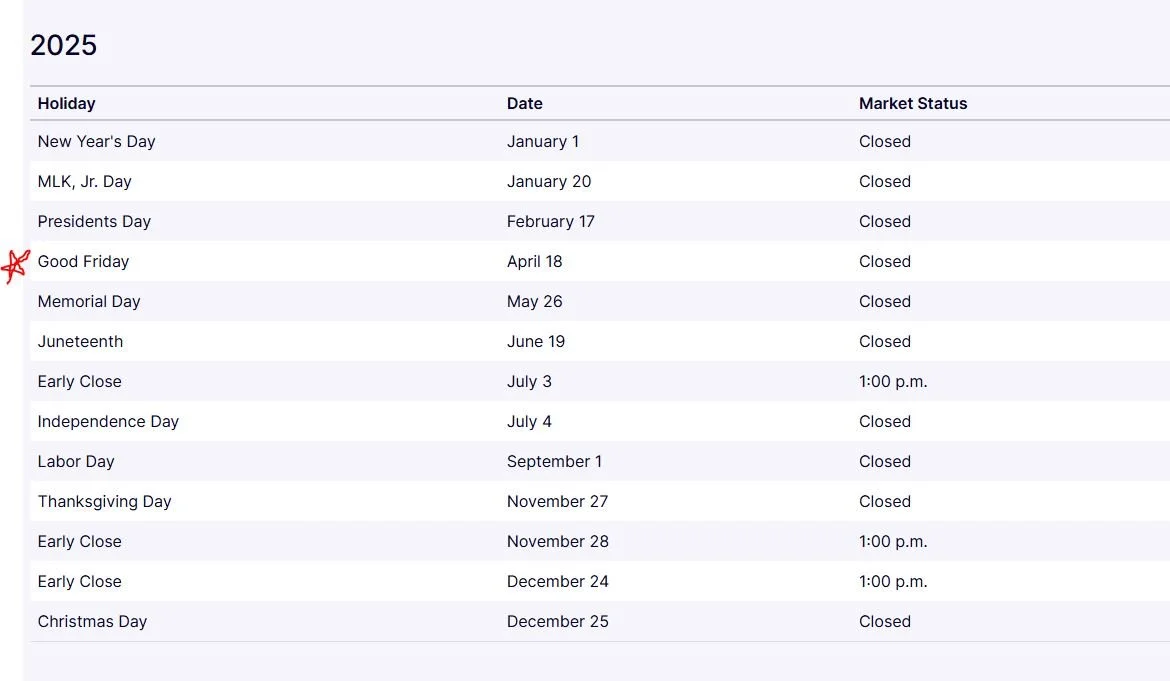

Here is the list of the market holiday’s which does include this coming Friday. Here is the link to the CME Group hours as well https://www.cmegroup.com/trading-hours.html#tradeDate=2025-04-18

Looking ahead to my NQ levels for this week:

I am writing this before we open on Sunday so the levels are based off last week with no true indication from the potential gap that comes from the headlines yesterday. I will amend the writeup sometime tonight when I get more information but in the meantime the levels are still valid. I will watch the 18,707 level carefully for support I have found it very reactive even with all the headline information. To the upside I like the 19,134, 19,387 and 19,700 levels as useful areas of interest. If we catch a bid and burn through 20,000 then watch the pre tariff high of 20,044 as a key level. Downside levels are the 18,241, 17,918 and 17,351/17,400. Overall the headlines and timing around these levels could lead to invalidation quickly. Make sure you have some sort of newsfeed open at all times while in the markets. This is still a heightened volatility market and I will continue to scale down until you get a better feel of more muted, clean behavior.

NQ LEVES TO WATCH

POLICINGPIPS FOR BEST RATES ALWAYS!!!

It feels soooooo good to be back!!!!! We have good news as well. We partnered with The Futures Desk!

TFD is new to the Futures Funding space and has a whole new outlook on how things are done.

Customize your eval. From drawdown to targets and even how much it costs, you are in control!

USE CODE POLICINGPIPS FOR BEST RATES ALWAYS!!!!

Once past your eval, there is no sim, it is straight to LIVE BROKERAGES!

Top of the line back end and journaling software they put you in the position to succeed.

USE CODE TFD15 FOR 15% OFF HERE ON THIS SITE!!!!

I HAVE PAUSED ALL STREAMING STILL UNTIL FURTHER NOTICE! I WILL BE BACK IN DUE TIME BUT I NEED TO REFOCUS IN ON THE PROCESS AND THIS IS PHASE 1!!! SEE YOU SOON IN THE MEANTIME PLAN YOUR TRADE, TRADE YOUR PLAN! DON’T DO DUMB $HIT!!!!

As always if you have any questions or comments about this writeup, my trading, the coffee or just want to say hi, please fill out the form below and leave some comments! Everything I share here is for your benefit, if you would like me to add any information or analyze some other charts please let me know as I will only add something if I am trading it otherwise.