weekly Market Outlook 3.23.25

First off, apologize for not getting this out last week as I ended up home late and the baby duty was calling. Prioritized family first as you should too. Now that is out of the way let us take a look at what we have seen and where we stand to potentially trade to this week.

Last week we opened and pressed above the previous week consolidation. We moved above that 19,700 level which was an area of resistance all week prior. The entire week was back into my zone from the low of 19,700 and up to 20,050. The week was dictated on the FOMC on Wednesday as well as triple witching on Friday. Overall there were no surprises and nothing that would move the markets up and out of this range. Seems like participants are still slightly fearful of the headline risk and were okay playing in that range all week long. The one thing I did notice was on the Market Imbalances and into the close on Friday we got a high volume spike to the upside. This has also continued into the open here on Sunday where we have gapped up and out of that consolidation zone, however there is still liquidity here that may be looking to sell back to the lows, so lets take a look at the week ahead for more context.

Normally I like to show the previous week only, however for context I think that seeing the week prior allows you a better sense of what I said above and visually it shows the acceptance of higher prices, for now.

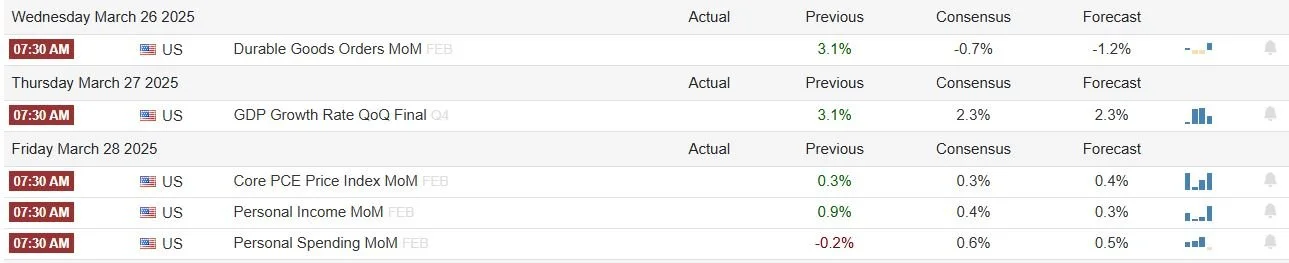

Below are the Red Folder events for this week:

Still looking like we are not so interested in individual data points as much during this market cycle as much as headline risk, tariff talk and major macro events. Even with this being the case you should always be aware of these releases, the time of them and how to manage positions that you are either in or looking to get in around these. This is the end of the month and quarter so data sets to be more important come next week.

Looking at the earnings reports for the week ahead:

I am not an equities trader at the moment and none of these names currently play much of a role in what I am watching for my trading week ahead. Overall it is a good habit to really understand that earnings are an important time for traders and you should always keep them at least in the back of your head. Unless you trade them directly then watch them daily.

Headlines moving markets right now:

Tariff talk is all that the market cares about these days, or so it seems. I recently saw a tweet(X) that I cannot find now but it referenced that each release of Tariffs saw some vol spikes and then a return back to the price referenced. Overall the tariff war may be blown out of the water and participants may care less and less each time they hear it. So keep it in mind that you will get spikes on releases, could it be something to fade or this time will it follow through?

Stuck in this zone here of extreme fear for a few weeks and you can see the market stepping up finding some lows. Lets see how long this holds on and if we do have any continuation to the upside will this fear start to turn into bullish optimism.

Looking ahead to my NQ levels for this week:

As mentioned in the intro we have a gap and hold situation playing out as I write this. Overall we saw the lows hold in the past few weeks and a return above the 20,000 key number has us feeling bullish. The zone we are gapping up over I have had as a longer term support zone. Last week this zone acted as a range and today we have gapped up and out of that zone. As we hold above we can anticipate the bulls to try and pull us up to the gap down zone from a few weeks ago. Up to 20,140 and ultimately the gap is 20,200. Should we be able to hold that then the next bigger zone above is 21,000. Be mindful of the resistance levels at 20,371, 20,538 and the 20,666 level.

Should we fail this gap up a rotation back down to the bottom end of last weeks range is possible to about the 19,600 level. If that support breaks the weekly low would make it to about that 19,170 support. Any headline catalyst will need to be watched and see what happens should we be in the area of these levels. Overall this is showing continuation to the upside, however it is always a wait and see game. We could come into the open tomorrow with the gap completely filled. Overall trade what you see and not what you want to see.

POLICINGPIPS FOR BEST RATES ALWAYS!!!

It feels soooooo good to be back!!!!! We have good news as well. We partnered with The Futures Desk!

TFD is new to the Futures Funding space and has a whole new outlook on how things are done.

Customize your eval. From drawdown to targets and even how much it costs, you are in control!

USE CODE POLICINGPIPS FOR BEST RATES ALWAYS!!!!

Once past your eval, there is no sim, it is straight to LIVE BROKERAGES!

Top of the line back end and journaling software they put you in the position to succeed.

USE CODE TFD15 FOR 15% OFF HERE ON THIS SITE!!!!

I HAVE PAUSED ALL STREAMING STILL UNTIL FURTHER NOTICE! I WILL BE BACK IN DUE TIME BUT I NEED TO REFOCUS IN ON THE PROCESS AND THIS IS PHASE 1!!! SEE YOU SOON IN THE MEANTIME PLAN YOUR TRADE, TRADE YOUR PLAN! DON’T DO DUMB $HIT!!!!

As always if you have any questions or comments about this writeup, my trading, the coffee or just want to say hi, please fill out the form below and leave some comments! Everything I share here is for your benefit, if you would like me to add any information or analyze some other charts please let me know as I will only add something if I am trading it otherwise.